SpaceEval

Our framework to measure the retail potential of a site (cityscaping, catchment profiling)

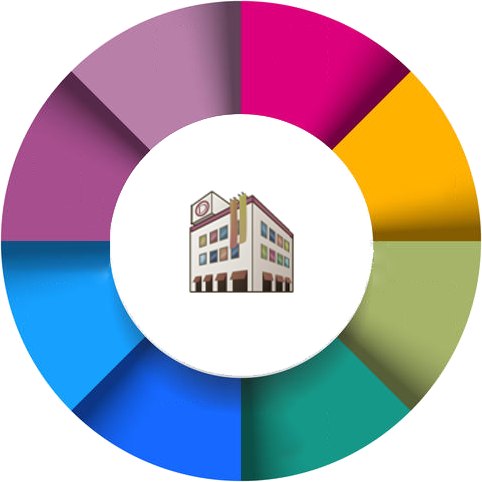

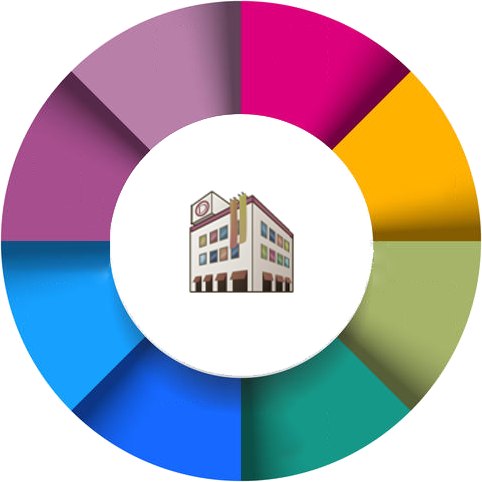

Environment

- Local Economy

- Social / Cultural

Catchment / Topography

- Zone Constitution

- Target HHLs

- Accessibility

Rentals

- Asking Rates

- Benchmarking with other properties & hi-streets

Competition

- Current & Upcoming properties

- Likely Retailers

Consumption

- Likely demand for retail space

- Key categories & spends

- Gap analysis

Affluence

- Durable ownership / services

- HHL (SINK / DINK / …)

- Demography

Shopper Behavior

- Types of retailers visited & desired

- Satisfaction

Consumer Behavior – F&B

- Types visited & desired

- Satisfaction

- How do they club it with other shopping activities

Environment

- Local Economy

- Social / Cultural

Catchment / Topography

- Zone Constitution

- Target HHLs

- Accessibility

Rentals

- Asking Rates

- Benchmarking with other properties & hi-streets

Competition

- Current & Upcoming properties

- Likely Retailers

Consumption

- Likely demand for retail space

- Key categories & spends

- Gap analysis

Affluence

- Durable ownership / services

- HHL (SINK / DINK / …)

- Demography

Shopper Behavior

- Types of retailers visited & desired

- Satisfaction

Consumer Behavior – F&B

- Types visited & desired

- Satisfaction

- How do they club it with other shopping activities

Positioning

Targetable Rentals

Prevailing trade practices

Competition